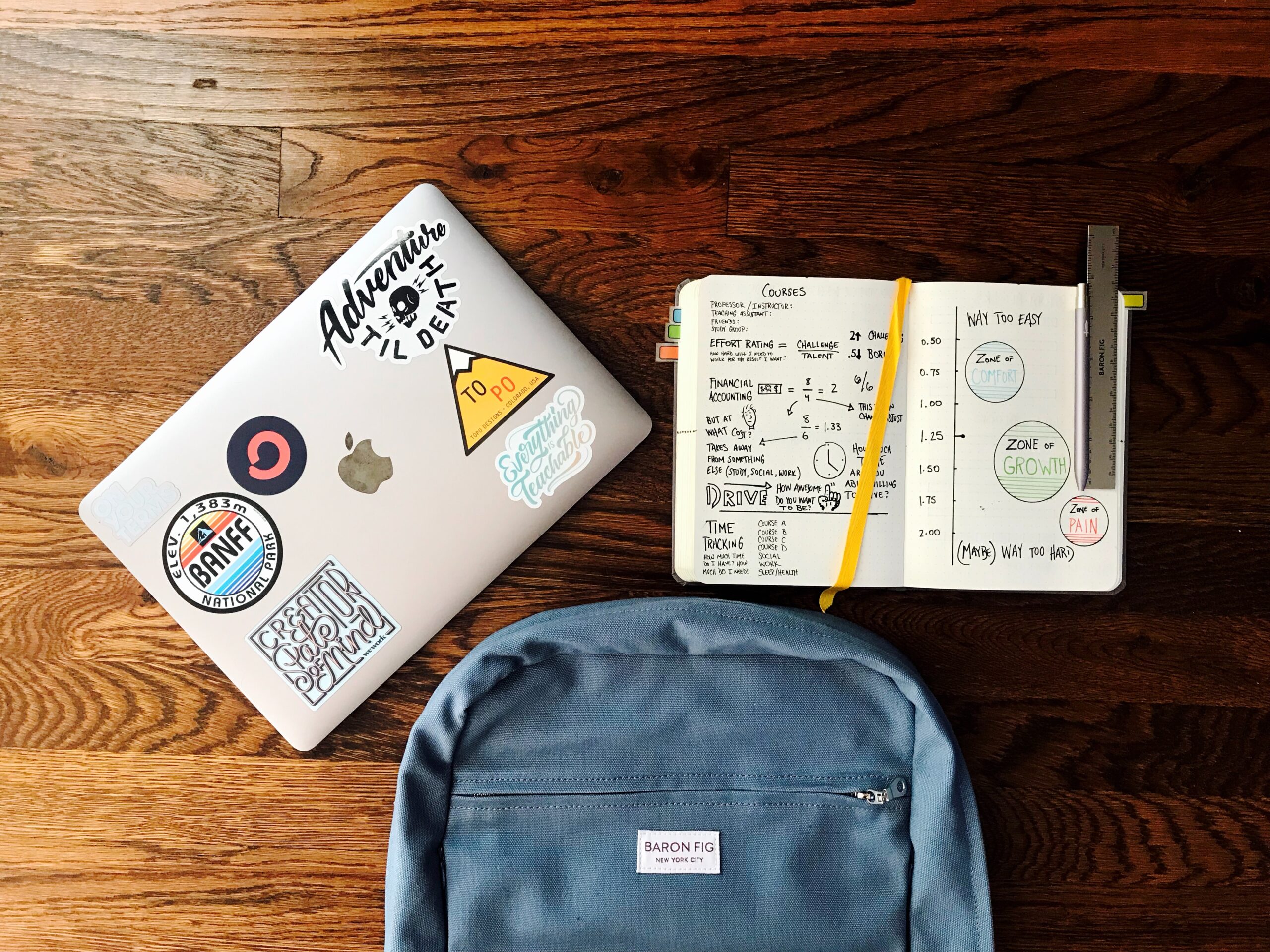

It’s that time of year again. Summer’s behind us and the leaves are turning red, yellow, and brown. Whether this is your child’s first time away at college or going into their second, third, or even fourth year, keeping your child’s school possessions, such as their laptop or bike, safe should be a priority. You might be wondering what kind of insurance will cover them, whether that’s a policy that needs to be acquired separately or if they’ll have coverage under your existing home policy like they would have when they were still living at home. AHI Group is happy to keep parents and students informed as we begin transitioning back into school. For many, this can be an exciting, stressful, or even overwhelming time – so we’d like to take at least one worry off your shoulders. The short answer is: yes, your homeowners insurance will provide some coverage for your college student’s belongings, but conditions can apply.

If Your Child is Living in a Dorm…

Then coverage will typically apply. For example, say your child’s bike was stolen. In this case, and assuming your student is living on campus in a resident dorm, your home insurance may cover the costs to repair or replace the bike. Your home insurance might also apply if your child accidentally injured someone or caused damage to campus property (although it would be your personal liability coverage that would kick in, not your contents coverage).

Depending on the insurer, however, coverage can vary and be limited. You’ll need to discuss your child’s situation with your insurer to confirm that they will have coverage. Oftentimes, the insurer will require the child to be under a certain age and live in a campus dorm. They may also limit how much they will pay out for property damage/theft that occurs while your child is living away from your home.

How Does Home Insurance Cover a College Student Living on Campus?

As long as your child meets your insurer’s qualifications, they can have coverage under their parent’s home insurance policy. In this case, two aspects of your home insurance (as the parent) will apply in the event something happens: your contents coverage and your personal liability coverage.

- Your personal property coverage may help your child cover the costs of repairing or replacing any of their belongings if they’re stolen or damaged (although the damage would have to be due to a covered peril, like weather or fire.)

- Your personal liability coverage may help cover your child if they are legally responsible, or liable, for damages to property or someone else’s injuries. This coverage can pay out for damages, including property repair, medical bills, and legal defence.

In the event, that your child’s dorm is broken into and their laptop is stolen, or they’re held responsible for damaging campus property accidentally, you could file a claim with your insurance company, who could then reimburse you for the stolen laptop or pay for the damage costs. Your child should keep an inventory with receipts or other documentation of their belongings to expedite the claims process and ensure a quick and fair settlement.

You would also still be responsible for paying out your home insurance deductible in the event of a claim, specifically when you’re filing a claim under the contents portion of your coverage. Common policy deductibles range between $500 to $1,500, so if the amount lost is anything less than this, your claim would likely end up being denied.

When Would a Child Not Be Covered?

Certain insurers may not insure your student away from home while attending college if they:

- Don’t live on campus/college-sanctioned housing

- Are older than a specific age (usually 25)

- Are not a full-time student attending the college

If your child lives in a separate apartment or building off-campus, then they would likely need their own tenant’s insurance policy to cover their belongings.

When Does My Child Need Renter’s Insurance?

College students may be deemed ineligible for coverage under the parent’s homeowner’s policy if they are living off-campus, or sometimes if they’re not a full-time student or above a certain age. They may, at this point, need their own renter’s insurance. Renter’s insurance is a limited form of home insurance that covers the tenant’s liability and belongings. Usually, the building that the renter is living in will be covered by the landlord who owns the property (hence why the tenant’s insurance doesn’t include a dwelling component, as the building isn’t owned by them.)

Renter’s insurance is one of the cheapest insurance policies on the market, costing as little as $10/month with relatively low deductibles. Certain companies will also offer dorm insurance, which is very similar to renter insurance but a little more tailor-made for those living in dorms and not apartments.

Plus, if your child has a car, they can qualify for a multiline policy discount by bundling their renter’s insurance with their auto policy! Most, if not all insurers offer bundle discounts for renter’s insurance.

Discuss with an AHI representative today if you’re sending off a child to school and you’re concerned about coverage for their possessions. We’re happy to discuss existing coverage and to explore the possibility of a separate renter policy for your child.